40+ Home point financial mortgage calculator

A home equity loan commonly referred to as a lump sum is granted for the full amount at the time of loan origination. Virgin Money Australia Pty Limited ABN 75 103 478 897 promotes and distributes the companion account and the home loans as the authorised representative and credit representative of the issuer and credit provider Bank of Queensland Limited ABN 32 009 656 740 Australian Credit.

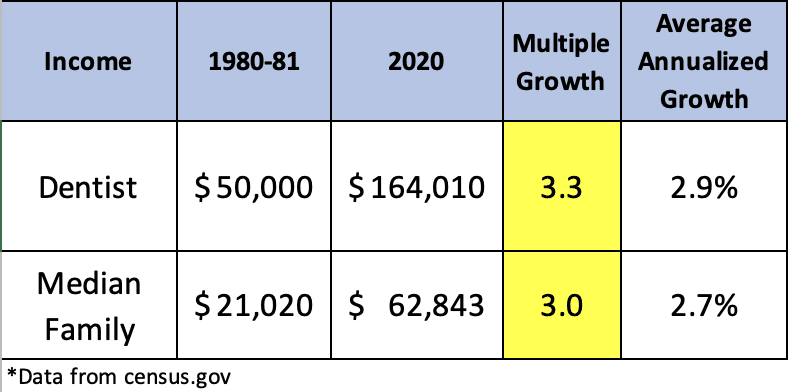

How Dental School Costs Have Changed Over 40 Years Student Loan Planner

TMUBMUSD10Y A complete US.

. You can choose to split your mortgage 50 fixed and 50 variable or even 60 fixed and 40 variable. An ARM has a fixed rate for a set time for example five seven or 10 years and then adjusts periodically for the remaining. In order to determine the best cities for singles WalletHub compared 182 cities including the 150 most populated US.

These are also only available to older homeowners 62 or older for Home Equity Conversion Mortgage the most popular reverse mortgage product or 55 and older for some proprietary reverse mortgages. Second mortgage types Lump sum. The split doesnt need to be straight down the middle.

Choose from calculators covering various aspects of mortgages auto loans investments student loans taxes retirement planning and more. PurePoint Financial is a member of the Mitsubishi UFJ Financial Group Inc which according to PurePoints website is the fifth largest bank in the world based on total assets. Buying points to lower your monthly mortgage payments may make sense if you select a fixed-rate mortgage and plan on owning the home after reaching the break-even period.

Use our mortgage calculator to estimate your monthly house payment including principal and interest property taxes and insurance. A 40-year mortgage with a variable rate Borrowers can get an adjustable-rate mortgage ARM with a 40-year term. You just need to provide inputs like the loan amount loan tenure and interest rate.

And the mortgage company explained that rising mortgage rates which are now at the highest level since the Great Recession 2008-2009 could have a domino effect softening construction activity and ultimately decelerating historically high housing prices. However expect 15-year fixed mortgages to have expensive monthly payments. Each point you buy costs 1 percent of your total loan amount.

Other Mortgage and Financial Calculators. Mortgage Overpayment Calculator Use our Mortgage Overpayment Calculator to see how overpaying your mortgage payment can reduce the total cost of your mortgage. Choose from calculators covering various aspects of mortgages auto loans investments student loans taxes retirement planning and more.

Mortgage Calculator Use our quick mortgage calculator to calculate the payments on one or more mortgages interest only or repayment. A 40-year mortgage extends the mortgage term by 10 years when compared with a traditional 30-year mortgage. A split home loan isnt technically a loan its an interest rate structure where one portion of the home loan is fixed and the other portion is variable.

1 Economics 2 Fun Recreation and 3 Dating Opportunities. Home Loan EMI Calculator Free Excel Download Home Loan Amortization Free Excel Download 2022. Besides gaining home equity faster it also generates lower interest charges over the life of the loan.

Each point lowers the APR on the loan by 18 0125 to 14 of a percent 025 for the duration of the loan. While most homebuyers choose a 30-year fixed mortgage 15-year fixed mortgages allow you to pay for your loan in half the time. RBI hikes repo rate by 50 basis points to 490.

Second mortgages come in two main forms home equity loans and home equity lines of credit. On widely expected lines the Reserve Bank of India RBI on June 8 2022 increased its short term lending rate the repo rate by 50 basis points as the countrys apex bank tries to bring down inflation from an eight-year-high levelThe six-member monetary policy committee voted unanimously in favour of the rate. This forecast expects home sales to slow down in the second and third quarters of 2022.

The loan is secured on the borrowers property through a process. When you remortgage to release equity youre arranging a new deal thats larger than your existing mortgage. To make it easy for you here is a free excel based Home Loan EMI Calculator that also shows you the loan amortization schedule.

Few homes are built to last 100 years. Invest Rate 015. Interest rates on such loans are fixed for the entire loan term both of which are determined when the second mortgage is initially.

As the Fed prepares to lift interest rates this year for the first time since 2018 heres where borrowers and savers can expect rates on key financial products to head in the months ahead. On Wednesday September 07 2022 the current average 30-year fixed-mortgage rate is 602 increasing 8 basis points over the last week. View the latest bond prices bond market news and bond rates.

10 Year Treasury Note bond overview by MarketWatch. Cities plus at least two of the most populated cities in each state across three key dimensions. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

In addition to the standard mortgage calculator this page lets you access more than 100 other financial calculators covering a broad variety of situations. Added 366 - days-per-year optionThis setting impacts interest calculations when you set compounding frequency to a day based frequency daily exactsimple or continuous or when there are odd days caused by an initial irregular length period. The 366 days in year option applies to leap.

For example if you bought a home for 200000 and your mortgage balance is 90000 your home equity is worth 110000. Fixed-Rate Mortgage Discount Points. The difference between your current mortgage balance and the new loan amount is the amount you will receive.

The material provided on this website is for informational use only and is not intended for financial tax or. Information is current as at 1 September 2022 and is subject to change. Most people need a mortgage to finance a home purchase.

In addition to the standard mortgage calculator this page lets you access more than 100 other financial calculators covering a broad variety of situations. Todays national mortgage rate trends. Get the latest financial news headlines and analysis from CBS MoneyWatch.

Other Mortgage and Financial Calculators. In 2016 the average mortgage term in Sweeden was reported to be 140 years before regulators set a cap at 105 years. In 2016 and 2017 many younger borrowers across the UK have moved away from using their once-standard 25-year mortgage toward 30 35 even 40-year loan options.

All inputs and options are explained below.

Percentile Rank Formula Calculator Excel Template

Understanding Social Security Bend Points White Coat Investor

Volatility Formula Calculator Examples With Excel Template

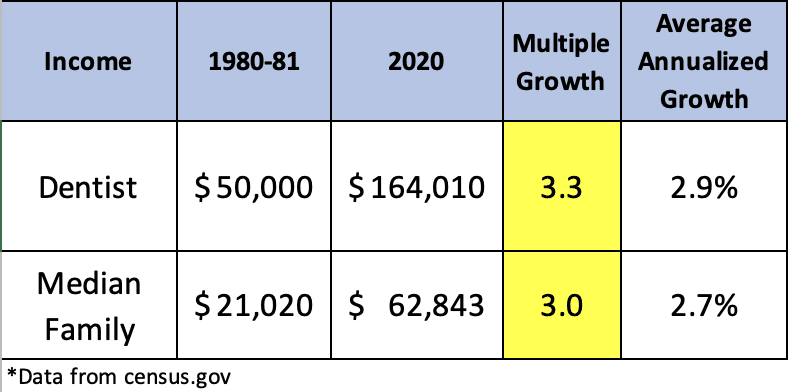

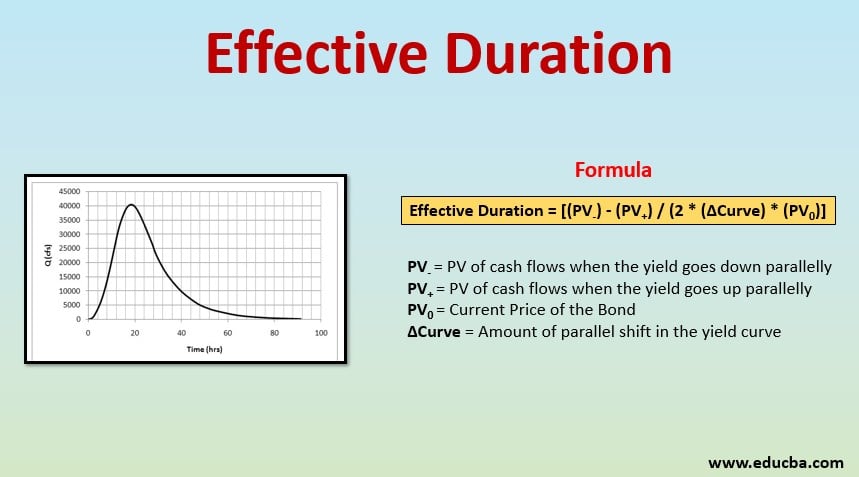

Producer Surplus Formula Calculator Examples With Excel Template

Understanding Social Security Bend Points White Coat Investor

A 15 Year Mortgage Is Probably Best But It Has One Big Disadvantage

Effective Interest Rate Formula Calculator With Excel Template

Fomc Realtor Com Economic Research

Understanding Social Security Bend Points White Coat Investor

Do Home Loan Rates Change On Your Existing Loan Quora

Best Mortgage Refinance Lenders For Lower Rates

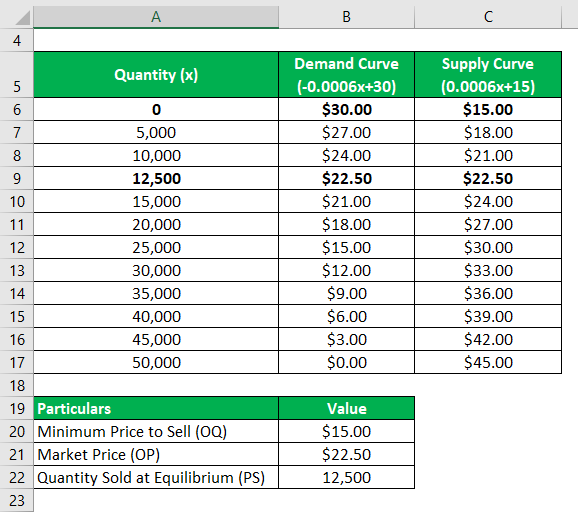

Effective Duration Formula How To Calculate Effective Duration

Mortgage Interest Calculator Principal And Interest Wowa Ca

Fed Raises Announces Biggest Rate Hike In 22 Years 50bps Realtor Com Economic Research

Operating Cash Flow Formula Examples With Excel Template Calculator

How Much Should You Save By Age 30 40 50 Or 60 Financial Samurai

Mortgage Rates Are About To Hit 3 For The First Time Since July R Realestate